WUNRN

Women & Remittances - Issues for Migrants Who Send

& Home Country Recipients

REMITTANCES– The monies sent from migrants in destination countries to families and communities in countries of origin are an important motivator for working abroad. Although individual migrants generally send relatively small sums of money, the accrual of remittances amounts to considerable financial flows.

MIGRATION, REMITTANCES &

GENDER-RESPONSIVE LOCAL DEVELOPMENT

UN Women & UNDP - This series of case studies focuses on the sending, transfer, receipt, and utilization of remittances. It affirms that gender influences and shapes the movement and experiences of migrants and their communities in both origin and destination countries. Case studies include: Albania, the Dominican Republic, Lesotho, Morocco, the Philippines, and Senegal.

The feminization of migration is a phenomenon that stresses not only the moderate increase in the numbers of women migrating, but also the ways in which women participate in migratory processes.In the past, most female migrants moved as dependents of husbands or families, whereas today a greater variety of women are leaving autonomously to work and live abroad as primary income earners. Growing interest in the study of the feminization of migration has created a knowledge base of experience and tools that lend themselves to the integration of gender equality into migration-related interventions.

Meanwhile, remittances – another significant feature of migration – are gaining international attention. The monies sent from migrants in destination countries to families and communities in countries of origin are an important motivator for working abroad. Although individual migrants generally send relatively small sums of money, the accrual of remittances amounts to considerable financial flows.

Recognizing remittances’ impact on national economies and the global financial world, governments and international organizations have taken interest in their potential to affect development. However, this potential to support and enhance human and local development has yet to be fully understood. A gendered approach to studying this phenomenon highlights how gender affects migrants’ experiences and how migrant women in particular can contribute to dialogues, policy planning and interventions for sustainable development.

Executive Summary & Country Case Studies: http://www.unwomen.org/~/media/Headquarters/Attachments/Sections/Library/Publications/2010/casestudy-executivesummary-migration-remittances-genderresponsivedevelopmemt-en.pdf

________________________________________________

http://www.youtube.com/watch?v=3eIQfTwtsgw

GENDER,

MIGRATION, REMITTANCES - VIDEO OF MIGRATION OF WOMEN FROM DOMINICAN

REPUBLIC TO SPAIN

_______________________________________________

Full

Article: http://www.irinnews.org/report/99977/remittance-rip-offs

POTENTIAL

"RIP-OFF'S WITH REMITTANCES

LONDON, 22 April 2014 (IRIN) - All over the world migrant

workers are sending money home to their families. The money pays hospital bills

and school fees, buys land, builds houses and sets up small businesses. The

cash goes from the US back to Mexico, from the Gulf back to India, from the UK

back to Somalia, and from South Africa back to Malawi, Zimbabwe and the rest of

southern Africa.

But what these workers probably do not realize, since

they usually only ever send to one country, is that the cost of sending money

varies greatly. Now a study of the cost of remittances, carried out by London's

Overseas Development Institute with support from the fund-raising charity Comic

Relief, has revealed that transfers to African countries cost around half as

much again as the global average, and twice as much as transfers to Latin

America........

______________________________________________________

http://online.wsj.com/news/articles/SB10001424052702303847804579479690660408488

Migrant

Women Increase Remittances

April

6, 2014 - Even when times were tough, immigrant

Silvia Navas says she never stopped sending money to her mother in

Ms. Navas and women like her are a

growing force in the economies of developing countries, a new study by the

Inter-American Dialogue, a Washington-based independent think tank, shows. It

found that migrant women surveyed in several major

The

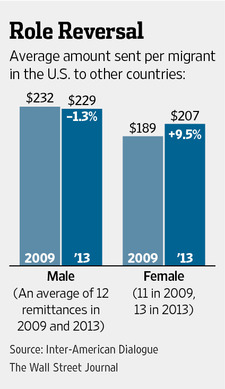

On average, women sent money to their

country of origin 13 times last year, with each remittance averaging $207,

according to the study, which surveyed 2,000 immigrants in five

Men sent money 12 times, at $229 a

remittance. And while men sent remittances worth about the same amount and with

the same frequency in 2013 as they did in 2009, during the recession, women

raised both the amount and frequency with which they sent money home over that

period, the study showed.

Among the possible reasons are that

migrant women tend to work in sectors such as housekeeping and other services

that are less vulnerable to economic swings than typically male-dominated

sectors like construction.

"I know a lot of people who lost

their jobs or worked less during the recession, but I kept my job," says

Ms. Navas, who sends her mother at least $200 a month.

About half of the 21.3 million

immigrants from Latin America and the Caribbean in the

Women migrants overall are more likely

to earn more money, particularly if they are educated. About one-third of Mexican

women working in the

All told, migrants from Latin America

and the

Behind the lackluster remittance

recovery is the fact that Ecuadorian, Paraguayan and Peruvian migrants have

been hurt by the poor economies of

Manuel Orozco, remittance scholar at the

Dialogue, believes overhauling the

In the meantime, a continued

A recent spike in immigration to the

The remittance study of migrants in the

"Formal savings are associated with

investments in human capital, like education, and small businesses," said

Ms. Lee, "We need to promote use of the banking system."

Among migrants in the

_________________________________________________________________________________________________________________________________________________________