WUNRN

Kenya & Uganda - Safe & Smart Savings Project for Vulnerable Adolescent Girls Empowerment

Working with financial institutions and girls’ programs in

Go Girl account holders march

through Kibera to raise awareness about the new girls' savings program. An adolescent girl in Increasing

attention is being given to adolescent girls’ economic empowerment. We have seen—and

expect to see on a larger scale—adolescent girls saving small amounts of money,

planning for future financial goals, and preparing for unexpected emergencies. In June 2008, at the start of

this project, there were no formal, accessible ways for girls in East Africa to

save their money, which increased their risk and vulnerability. Girls without

safe, planned places to store their savings have been robbed; suffered

harassment by family members, boyfriends, husbands, and others in their

communities; and become targets of sexual violence. Having access to savings

accounts can help alleviate some of these consequences as well as facilitate

the savings process. This in turn can increase adolescent girls’ economic

stability as they move toward adulthood. Girls also are not routinely

taught basic savings and budgeting skills, without which their ability to save

successfully and wisely manage their money is diminished. With the growing

trend toward encouraging girls to take charge of their own finances, they need

these skills to adequately prepare them to do so. Council researchers are

working with two financial institutions in Kenya and two in Uganda that have

already begun to develop ways for low-income clients to save money. We are

working closely with them to develop appropriate products and services for

adolescent girls that are delivered in the context of a program that encourages

girls' engagement and empowerment. With this project, the

Population Council is partnering with MicroSave, a consulting company with

expertise in market-driven financial product development, in addition to

financial institutions from Kenya (K-Rep Bank and Faulu Kenya Limited) and

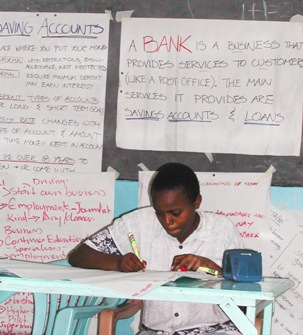

Uganda (FINCA-Uganda and Finance Trust). The proposed activities build on prior

work, including the development of a financial literacy curriculum for

adolescent girls in Kibera, Kenya, and a market research study on savings

products for adolescent girls in Kibera. Savings products are also designed to

build on what the Council has learned in regard to high-quality programming for

girls—including providing safe spaces and building social networks through

friends and mentors. As of the end of 2009, the

pilot project in Kenya has been completed (along with baseline and endline

surveys) and plans for countrywide roll-out are under way. The pilot project in

Uganda, with accompanying baseline survey, was recently launched.